The employer contribution for the employee is at 13 and 12 depending on the salary of the employee. Among the payments not liable for EPF contribution.

Employer Obligated To Pay Damages For Delay In Payment Of Epf Contribution Sc

If your employer fails to deduct your salary for EPF contributions at the time your salary is paid your employer cannot recover the contributions from you after a period of six months.

. Wages for maternity leave. EPF is governed by Employee Provident Fund Amendment Act 2007 referred as EPFA. There are seven types of payments that are exempted from EPF contribution.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. 8 of the total monthly earnings To be deducted from the employees salarywage. Award sums in dismissal cases are granted in the form of backwages and unless there is an express order by the Chairman of the Industrial Court employers are not required to make contribution in respect of the award sum.

20 of the employees total monthly earnings. What happens if the employer does not contribute to the EPF. Payments which are made to volunteers do not attract the operation of the EPF Act for the obvious.

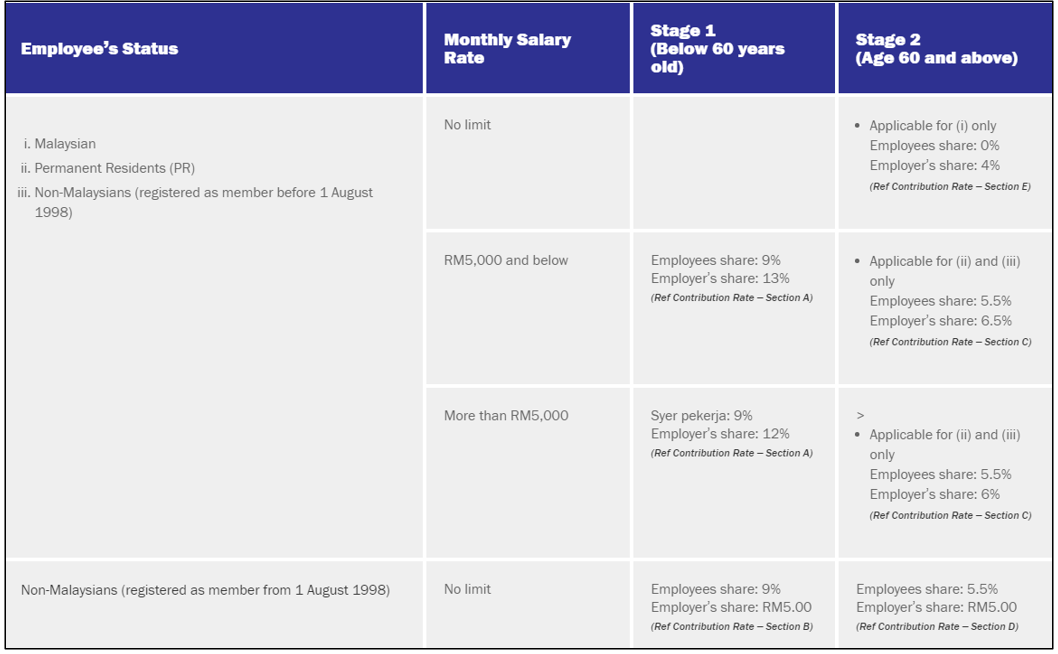

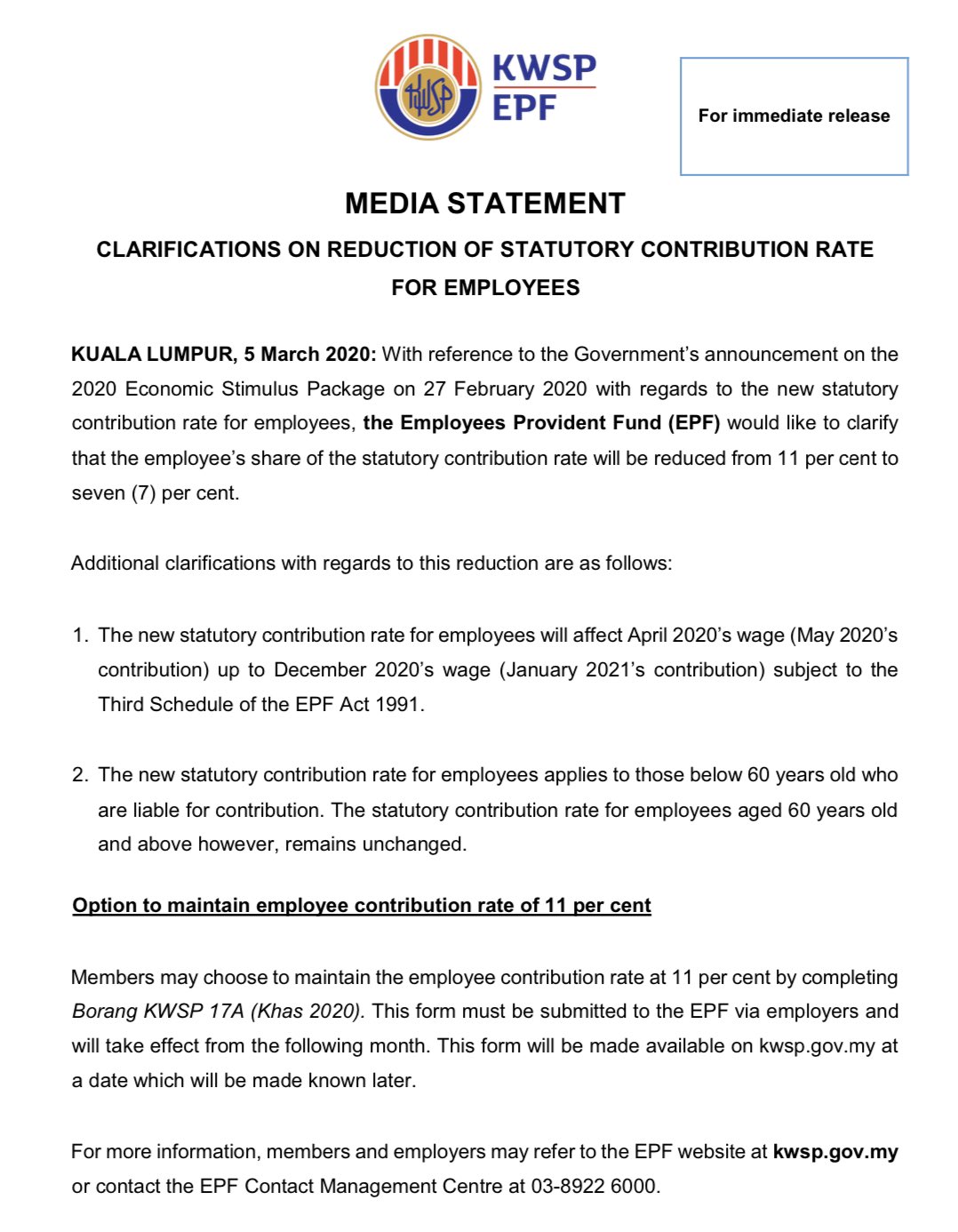

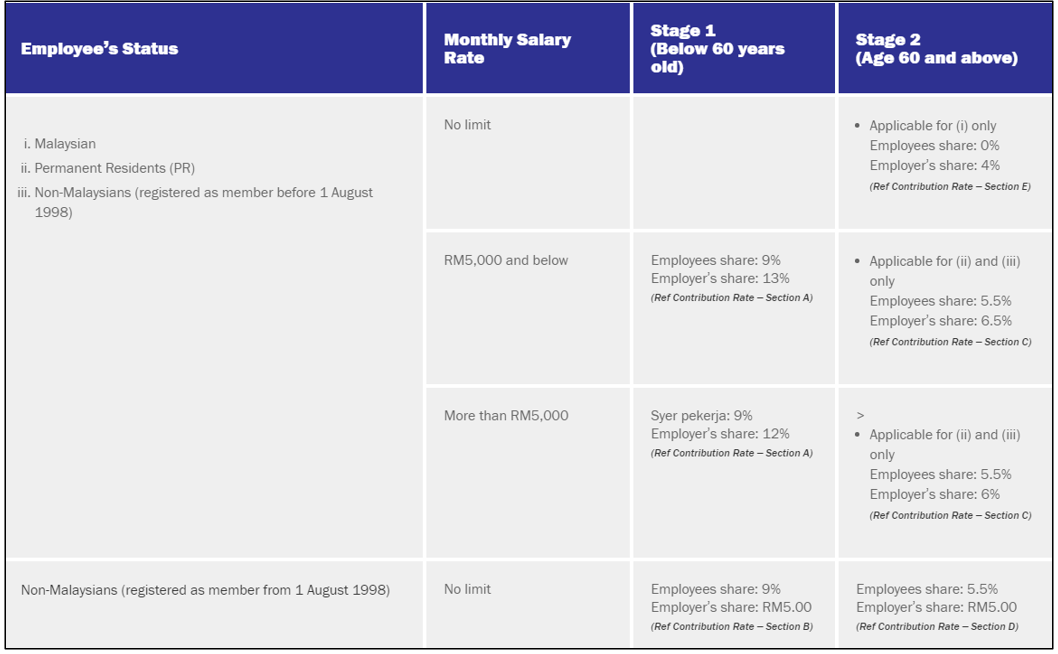

An Employer must register an employee and contribute to EPF even if he has only one Employee. Any employer who fails to make contribution on or before the 15th of every month shall on conviction be liable to imprisonment for a term not exceeding three years or to a fine not exceeding ten thousand. The contribution rates for employee below age 60 is 11 and for employee above age 60 will be 55.

On allotment of independent code number after complying with the prescribed conditions and submitting the list of 20 or more employees a contractor acquires the status of establishment may it be a Company firm society or sole proprietorship and becomes responsible for. The employer can be charged for not paying an employees EPF. Payment for un-utilised annual or medical leave.

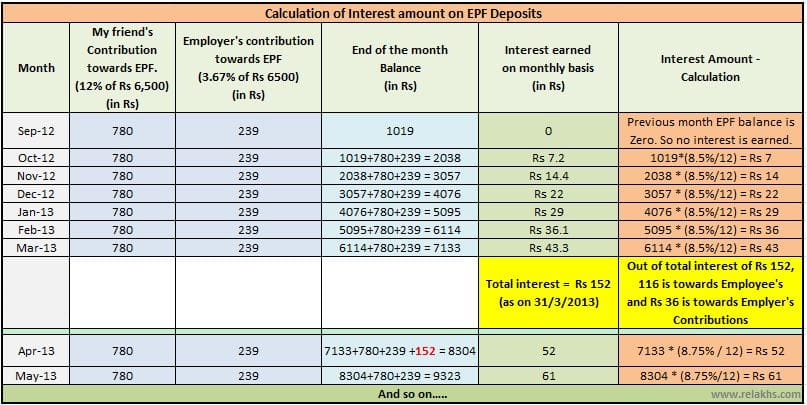

Bankruptcy Seizure. Total Contribution per Employee. Among the payments that are liable for EPF contribution.

PRINCIPAL EMPLOYER NOT LIABLE FOR PF. An amount equivalent to 12 of total monthly income of the employee To be paid totally by the Employer. An employee with a salary less than RM5000 will have employer contribution of 13 while more than RM5000 salary the employer contribution is 12.

Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF. The SC was hearing an appeal filed against the Karnataka High Court judgement which had held an employer is liable to pay damages if it fails to deposit the EPF contribution. According to Section 43 1 of the EPF Act 1991 every employee and every employer must make monthly contributions to the EPF.

For employees with monthly wages exceeding RM20000 the employees contribution rate shall be 9 while the rate of contribution by the employer is 12. Now the next thing. DUES OF CONTRACTOR - by HL.

The standard practice for EPF contribution by employer and employee are. For larger companies the penalties are even more severe. According to Section 46 of the Act failure on behalf of the companys director partners or association of persons to pay outstanding EPF contributions may leave the company liable to court action including.

Get Access to the Largest Online Library of Legal Forms for Any State. Under such circumstance your employer has to pay for both the employees and employers shares as well as the dividends accrued to the EPF. As for the amount that needs to be contributed this can be calculated based on the employees wages and the Third Schedule of the Act not by exact percentages unless monthly wages surpass RM20000.

Other payments under services contract or otherwise. Except for the persons mentioned in the first Schedule of the EPF Act 1991 you are liable to pay EPF contributions in respect of any person whom you have engaged to work under a Contract of Service or Apprenticeship. Wages for half day leave.

Wages for study leave. It is illegal for an employer and his employee to agree between them in the contract of employment not to contribute to EPF. Service Charge Any money or payment either in the form of a service charge a service fee a tip or other payments which has been paid by charged on collected from or voluntarily given by a customer or any other person who is not the employer with respect to the employers business.

Section 6 of the Employees Provident Funds and Miscellaneous Provisions Act 1952 PF Act requires the employer to make contributions to the provident fund accounts of each of its employeesAn employee under the PF Act is defined to include persons employed through a contractor in or in connection with the work of the establishment. Payments which are not liable for EPF contribution are- Service charge Overtime payment Gratuity Retirement benefit Retrenchment lay-off or termination benefits Any travelling allowance or the value of any travelling concession Any other remuneration or payment as may be exempted by the Minister Gifts. Section 432 of the EPF Act 1991 states that.

If employer fails to pay EPF contributions within the specified periods. Voluntary expenses or honorarium.

Is Your Employer Depositing Pf Money To Epfo Or Trust If Not Then What To Do

Written Submissions Epf Penalty Waiver Pdf Mens Rea Legal Concepts

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

Tax On Epf Withdrawal New Tds Rule Flowchart Planmoneytax

Epf A C Interest Calculation Components Example

Ibrahim Sani On Twitter For Those Of Us Who Are Contributing To Epf Please Make Sure You Ask Yourself If You Want Your Forced Contribution To Be Reduced To 7 Default Setting

Ibrahim Sani On Twitter For Those Of Us Who Are Contributing To Epf Please Make Sure You Ask Yourself If You Want Your Forced Contribution To Be Reduced To 7 Default Setting

Employees Provident Fund Epf Eps Edli Its Calculation Ceiling Limit Fund General Partnership Employee

Epf Latest News If There Is No Tax On The Interest Received On Your Epf Contribution Check This Way Edules

Epf A C Interest Calculation Components Example

What S Taxable Under New Epf Rules All That You Need To Know Hindustan Times

How Epf Employees Provident Fund Interest Is Calculated

How To Calculate Provident Fund Online Calculator Government Employment

Employer Must Pay Damages For Delay In Payment Of Epf Contribution Rules Sc Mint

What Is Epf Deduction Percentage Quora

Myfreelys Academy Kwsp Definition Of Wages For Epf Purpose All Remuneration In Money Due To An Employee Under His Contract Of Service Or Apprenticeship Whether It Was Agreed To Be Paid

Trending News Epf Latest News Interest Earned On Your Epf Contribution Is Not Being Taxed Check This Way Hindustan News Hub

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Everything You Need To Know About Running Payroll In Malaysia